In 2009, Palo Alto's elected leaders and top management responded to the financial walloping of the Great Recession by embarking on a path toward benefit reform.

Despite a worker protest in front of City Hall, a one-day strike by the city's largest union and a brief legal skirmish, the city succeeded in imposing a new contract on the Service Employees International Union (SEIU), 521, which represents about half the city's workforce. Under the new conditions, union members were forced to chip in for their pensions and health care costs -- expenses for which the city had traditionally picked up the tab. Over the next three years, the city negotiated similar concessions with all other labor groups, with the police union last year becoming the latest to adopt a cost-sharing contract.

Palo Alto's economic fortunes have flipped since then, with vacancies in downtown buildings now below 2 percent and sales-tax revenues rising steadily. But the city's effort to further curb benefits continues. Pension and health care costs are rising at an alarming rate all around the state, recently pushing cities such as Stockton, Vallejo and San Bernardino into bankruptcy. Palo Alto is nowhere near that point, and the city intends to keep it that way, City Manager James Keene said in a recent interview.

"The reality is out there in the world when you look at the bankrupt cities around the state and their inability to pay their bills," Keene said. "We keep coming back to the fact that we're not in that position and we're not anywhere close to it. That's because we keep focusing on how to manage these long-term costs and how we will get more savings or more cost-sharing."

Today, bringing down the city's health care costs is the highest and most contentious financial priority. Though the city has achieved some concessions since 2009, the City Council remains committed to a broader overhaul of benefits for the hundreds of workers who are covered. Some of the changes may start surfacing by the end of this year, when the SEIU's contract expires, and next summer, when the police and fire unions are up for new contracts.

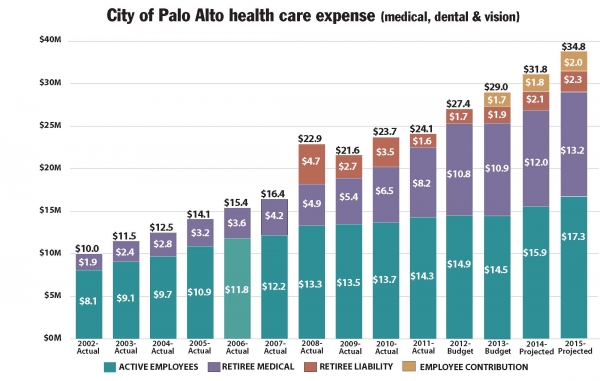

The topic of employee benefits has been recurring since last July, when four council members -- Pat Burt, Karen Holman, Greg Scharff and Greg Schmid -- released a memo sounding alarms about this trend in costs. The council members noted that employee benefits amounted to just 23 percent of salaries in 2002 and to 54 percent in 2010. Today, they account for 63 percent, and in 2022, they are expected to exceed salaries.

The city's benefits, the memo stated, are "reducing the funds available for our community's necessary and valued services and infrastructure." Since then, the city has been holding regular meetings to discuss further reforms, with the most recent one, centered on health care, taking place last month.

The problem is a sizable one even during financial good times. In 2012, the rising cost of benefits largely wiped out any savings the city had hoped to get through staff cuts and the recent employee concessions. According to employee-compensation data that the city released last month, the city's spending on employee benefits jumped by 8 percent between 2011 and 2012, canceling out the city's 3 percent decrease in salary expenditures and leaving the overall spending on employee compensation mostly flat.

While pensions and medical costs both contribute to this trend, it is the latter that will likely take center stage in contract negotiations that will kick off later this year.

With pensions, the city already took giant strides when it negotiated new contracts with more cost sharing by employees and additional tiers with less generous pension formulas for newly hired workers. The measures seem to be working. According to the new salary data, workers chipped in nearly $1 million toward their pensions in 2012, a balance that would have been picked up by the city in years past. In October, Keene suggested that the city has already "maxed out" on the actions it can take to reduce pension costs under the restrictions of the California Public Employees' Retirement System (CalPERS), the mammoth fund that administers Palo Alto's pension and health care programs.

Health care, meanwhile, remains a sore subject for budget officials, a painful one for employees and a puzzling one for the council, which is trying to strike the delicate balance between attracting top talent and keeping costs down. The city's health care costs per employee have risen from $609 in 2004 to $901 in 2009 to $1,080 in 2012, according to the latest Long Range Financial Forecast, an annual snapshot of the city's financial situation. The figures are expected to increase by an even faster rate in 2014, when new mandates from the federal Affordable Care Act kick in, raising premiums for the city by an estimated 9 to 10 percent.

While formal negotiations with the SEIU are yet to kick off, the city's early efforts to launch informal conversations with workers about health care reforms have not gone well. After two informal forums on the subject, employees submitted a letter accusing management of ignoring their concerns. The city, the union leaders claimed, "has clearly pre-engineered" the forums so it can "check the box on employee engagement." The unions also claimed that the city has failed to answer its questions about how the changes will impact long-term workers and retirees.

"All the employee groups question the wisdom and productivity of moving forward with even further changes in benefits when we can't even get a straight answer about the past change and what they mean for long-term employees," the union leaders wrote. "Collectively, we believe it will be difficult for any of us to gain support from our members for new benefit changes unless the inequity in retirement medical that was created by the last round of changes is resolved."

But from management's perspective, health care reform is the only option for keeping the city's finances in order. Last year, the council kicked off a series of meetings aimed at exploring options for reducing benefit costs. With pension reforms already in effect, health care is next. The city is exploring a range of options, including raising the employee portion of the burden and creating new plans that give the city more flexibility in managing costs.

"To really protect the availability of benefits in the future, we're going to have to manage costs better and have better cost-sharing or else the results would be much worse," Keene said in an interview last week. "We can't just pretend that we can continue on this path that has led a lot of cities toward bankruptcy."

------------

The idea of reforming Palo Alto's health care system isn't new. Fresh ideas resurface every few years and typically involve tense bargaining and incremental progress. The city's last effort, in 2009, resulted in a cost-sharing arrangement for the city and its employees, an agreement under which the city would pay 90 percent of the health care costs and employees (including new retirees) would pay 10 percent (the city had previously footed the entire bill). The contentious reform helped push dozens of midlevel managers and other senior employees to retire to avoid the reduced benefits and prompted a protest and a one-day strike from SEIU, the city's largest union and the first to deal with the benefit concessions. The city ultimately imposed the reduced benefits unilaterally.

These reforms, however controversial, were far less drastic than the ones the city had considered in the more distant past and the one it plans to explore in the near future. For many decades, Palo Alto administered a self-funded health plan that provided retirees (though not their dependents) with medical coverage. According to a recent report from the Human Services Department, this changed in the 1980s, when the cost of providing this coverage shot up by about 50 percent over a three-year period, forcing the city to seek alternatives.

That's when Palo Alto joined dozens of other California cities in signing up for CalPERS, the fund that now provides health care coverage to 1.3 million people. At the time, CalPERS rates were rising by about 6.2 percent annually, a relative bargain, and its 12 different plans looked attractive when compared to the one offered by the city. When the city chose CalPERS in 1993, its driving philosophy was "providing employees with choice and stabilizing cost," the Human Resources report states.

But the switch came at a price. Agencies participating in CalPERS are governed by the Public Employees Medical and Hospital Care Act, which requires agencies to provide contributions to active employees and retirees on an equal basis. Information the city can obtain about its workers' health care needs is far more limited now because costs and risks are aggregated among all participating agencies. And the number of health care plans employees can choose from has shriveled from 12 to six since the city joined.

In recent discussions, council members have frequently voiced concerns about the many limitations that the CalPERS system imposed on the city, with Larry Klein saying that the system in some ways "straight jackets" the city. And Liz Kniss, a leading proponent of wellness programs, bemoaned the fact that CalPERS doesn't provide cities with information on offering incentives for wellness programs. She called these programs "one of the most promising areas in the whole sphere" of health care.

"I'm disappointed that CalPERS doesn't provide that kind of information. This is the kind of thing that makes an enormous difference in employees and in costs over the long run," Kniss said at the council's Feb. 4 discussion of health care reform.

Even so, CalPERS remains the only viable alternative for the city. An attempt by Palo Alto and other cities to start a health care cooperative about five years ago fizzled when costs proved too high. Today, buying insurance on the open market remains cost prohibitive because of the city's large number of expensive retirees. And the city's risk is compounded by the fact that if it leaves CalPERS, it would not be allowed to return to the system for five years.

Faced with these limitations, Palo Alto has spent the last decade baby-stepping toward reform. In 2006, it switched from a five-year vesting schedule for retiree benefits to a 20-year vesting schedule, which gradually increases health care benefits based on tenure (after 20 years, the city would pay 100 percent of the cost).

Recent cost-sharing measures, which now apply to all unions (though the police union is rebuffing the city's attempt to apply it to retirees), have also had some effect. In the current fiscal year, Palo Alto's per-employee cost is expected to actually dip to $1,075 (a decrease of $5 from 2012). But the council and top management all agree that this is not nearly enough. For one thing, medical costs are expected to escalate far faster than the city's revenues, with estimates ranging from 7 percent to 10 percent. For another, more than half of the city's health care recipients are now retirees rather than active workers, which means that they get benefits without making any contributions. And while the number of retirees grows every year, the number of active employees stays largely static, making the situation even worse.

"We're in many ways carrying a whole shadow organization that is significantly larger than our active organization," Keene told the council on Feb. 4, alluding to the retirees.

------------

The most significant, and controversial, reform proposal currently on the table is one that would scrap the existing "defined benefit" system, which includes six bulky packages from which employees can choose and which keep the benefits steady even in the face of rising costs. Workers and retirees can currently choose to get their health care through one of two HMOs (health-maintenance organizatoins) -- Blue Shield of California and Kaiser -- or four PPOs (preferred provider organizations) -- PERSCare, PERS Choice, PERS Select and the Peace Officers Association of California, which is only available to public-safety members.

What CalPERS lacks, and what the city hopes to offer one day, is a low-cost or high-deductible option for employees who are healthy and would rather not pay for a full-service plan.

This option would be part of what are known as flexible "cafeteria plans," which allow workers to pick the coverage of health care services they need rather than simply choosing a full-service plan. They would also give the city more power to buy only the services its employees need, rather than the ones selected by the CalPERS board of directors. These flexible plans, the thinking goes, would give employees more control over benefits and give the city more control over costs.

The latter point is a particularly poignant one for Human Resources officials. During the detailed Feb. 4 discussion, Chief People Officer Kathryn Shen projected that health care will continue to increase at a rate that is 2 to 5 percent above the inflation level. She called this a "sobering thought."

"From a retiree perspective, you're on a smaller income and your health care costs are going up more than inflation -- that's a problem," Shen said. "It's also a problem for the city because that same inflation-plus plan impacts our ability to provide health care."

Liliana Salazar, senior vice president for compliance for Wells Fargo Insurance Cities, the city's insurance broker, predicted health care costs are expected to rise nationwide by 9 percent on the "lowest end of the scale" and most likely by about 10 percent in 2014, when new mandates from the Affordable Care Act (also known as Obamacare) kick in. Salazar recommended the "flexible plan" as one action the council can adopt to manage these costs. She said many other agencies in California and elsewhere are now working through such changes.

"Most agencies are transitioning from a defined structure to a much more flexible structure,'" Salazar told the council.

The council indicated at the meeting that it supports such a switch and directed staff to consider this option as well as others that "may be considered for negotiation with represented employees and discussion with management employees."

The main barrier for the city is getting employees to buy in, both literally and figuratively. A switch from a defined-benefit plan to a flexible plan would be subject to collective bargaining, and so far, employees have been opposed to seeing their recently reduced benefits pared down further.

While formal negotiations are still months away, the unions have already made their positions clear. Rather than attend the Feb. 4 discussion, as they were scheduled to do, leaders from the main labor unions sat out the meeting, instead submitting letters that voiced frustration and hinted at future litigation. Employees, in a letter signed by most of the major labor groups, charged the city with ignoring their concerns and proceeding with a predetermined and largely unpopular outcome.

Recent efforts by Human Resources officials to discuss the pending changes at forums did little to alleviate these concerns, according to the unions. At two meetings, workers were given a list of benefits and asked to place dots next to those they deem most valuable. Some were allegedly surprised that the issue of "retiree medical," for many the hottest button, wasn't on the list until employees requested it.

Union leaders also claimed that staff "refused to answer questions" about how long-term employees would be affected by the cafeteria plan. The forums, the letter stated, "ended with employees overwhelmingly expressing their desire to protect active and retiree medical benefits and leaving employees with no answers to their questions on retirement medical."

"Based on the outcome of recent prior collaborative efforts and the HR statement of a current desire by a very small number of city staff (in leadership positions) to implement a flexible benefit plan, the employee groups are frustrated by the lack of true engagement and lack of willingness to work with us or answer key questions about our promised benefits long-term employees are already vested in," the letter stated. "Moving forward with a cafeteria-type plan for active employees has the potential to decimate the retirement medical coverage for long-term employees."

Shen and Keene both called the unions' characterization of staff's position unfair. Shen told the Weekly that the city hasn't really started the cafeteria-plan discussion and isn't sure this is the direction in which the city is going.

"No doubt we talked about this as a possibility," Shen said. "But we don't have a cafeteria plan in our back pocket. We absolutely know it's something that would be discussed in bargaining."

Keene said the initial meetings were an "invitation that HR offered to folks to describe some of the challenges we have and to talk about some of the alternatives."

"Nothing in the process is designed in that setting to drive to solution," Keene said.

Unions, for their part, say they remain committed to helping the city save costs and noted in recent correspondence with the Weekly that they are not currently in negotiations and that there are no formal "proposals" from the city at this point. Brian Ward, one of the SEIU leaders, said that all labor groups have joined together and "have proposed cost savings solutions in the past that were not given serious consideration by the city." He also said labor groups have "recently requested to begin discussions with the city on ways to reduce expenditures to preserve city services.

"We have not received a response from the city to date," Ward said.

He also criticized the city's early attempts to introduce health care changes at the two employee meetings.

"Labor groups did not feel this was productive or collaborative, and we have not heard back from the City on the outcome of those meetings," he wrote.

Sgt. Scott Savage, president of the Palo Alto Police Officers Association (PAPOA), said the union has not received any proposals from the city for a cafeteria plan but remains "open to exploring any cost-saving opportunities in the area of employee health care costs."

"The PAPOA has supported proposals in the past that would have resulted in significant short- and long-term health care cost savings to the City," Savage said in an emailed statement on behalf of the union.

City officials maintained on Feb. 4 and in recent interviews that no decisions have been made and that nothing will happen until the two sides meet at the bargaining table. Both Keene and Shen said the unions had mischaracterized the city's early attempts at informal talks about benefit changes. But in a recent interview, Keene made it clear that some change is inevitable.

"We're either going to do some course of looking at greatest cost-sharing -- whether it's 90-10 becoming 80-20 or whatever -- or we can look at something like flexible benefits that give employees more choice and allow cities to focus on how much incremental cost we can provide on our side as a way to manage costs.

"I think flexible benefits will have to be a big part of the discussion but not the only thing," Keene said.

------------

Palo Alto officials often boast about the progress the city has made toward a balanced budget since 2009, when the Great Recession took a heavy bite out of local tax revenues. But the reforms had one significant unintended effect: They prompted a wave of retirements from some of the city's long-serving employees and put further pressure on the city's already precarious health care picture.

Today, there are 860 retirees and 844 employees enrolled in the city's CalPERS health care plans, according to a recent report from the Human Resources Department. The high number of retirees puts the city in a difficult quandary, driving up costs and making a switch from CalPERS to the open market even less feasible.

"The city's ratio of early retirees to actives is so high that it is a barrier to obtaining coverage quotes from the open market, based on input from insurance representatives," the report states. "Early retirees incur higher health care costs compared to active employees, which insurers specify as a reason to charge higher insurance premiums."

What makes matters worse is that many of these retirees have just left and remain too young to qualify for Medicare, a factor that further ups the city's costs. Of the 860 retired employees, 377 are "early retirees," according to the report. Things are likely to get worse before they get better. According to Shen, about half of the city's workforce is set to retire in the next decade, further expanding what Keene called the city's "shadow organization."

This demographical trend and its grim financial implications pose a particularly tricky challenge for the city council and top management. Councilman Schmid spoke at length about this topic Feb. 4, when he criticized the city's tendency to hire workers who acquire experience in other cities, join the city at 35 or 40, work for a few years and then retire, saddling the city with retirement benefits for many years.

"Why don't we have younger workers -- more younger workers who stay active for longer in the city or go somewhere else to retire?" Schmid asked. "Our financial outlook would be much better."

Schmid observed that as the council proceeded to trim its payroll by cutting positions, it has actually, in a way, made things less efficient. Now, he said, there are fewer active employees who contribute toward health care and more retirees who collect benefits without chipping in.

"So if we meet our efficiencies by cutting employees, we are increasing our per-employee costs," Schmid said. "That's scary."

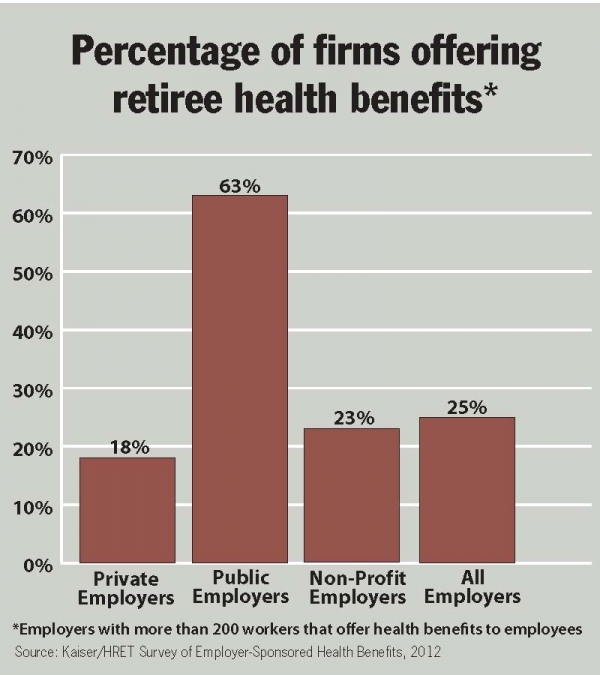

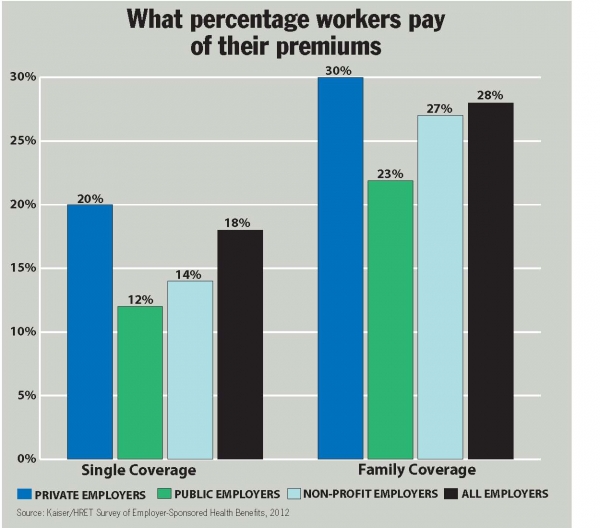

Palo Alto's legacy of generous medical benefits has helped fuel this trend. According to Kaiser Family Foundation's 2012 Employer Health Benefit Survey, public employers generally contribute more and require their employees to contribute less than their counterparts in the private sector. An average employer contribution in the private sector for covered workers with families is $10,704. In the public sector, it is $12,381.

Workers in the public sector also tend to use plans with higher premiums, according to the survey, with the employer picking up the lion's share. For public employers, the average premium in 2012 was $5,997, with the employee paying $698 and the employer paying the rest (in the private sector, the average premium was $5,297, with workers paying $1,053). It is perhaps significant that up until three years ago, Palo Alto footed the entire medical bill, which made it a particularly attractive destination for new employees.

"Cities that have the most generous retiree medical benefits act as magnets for employees late in their career, whether they're ones coming from other jurisdictions or ones coming from the private sector," Councilman Burt said Feb. 4. "To be able to retire with great medical benefits is a real attraction."

Getting retirees to chip in for health care has proven difficult for management. While most unions agreed, after long negotiations, to apply the 90/10 cost-sharing arrangement to new retirees, the police union has resisted this measure. Last year, when the PAPOA signed a new contract with the city, this issue was left conspicuously unresolved. The city and the union are now going through a process to determine whether the city has the right to reduce medical benefits for police retirees -- a subject on which the two sides have clashed.

Savage said in a statement that when it comes to cost-sharing on health care, the police union believes that "The city is contractually obligated to provide retiree health coverage to those hired before 2006."

"We are currently involved in a fact-finding mediation on this issue," Savage wrote. "We are optimistic that the neutral fact-finding panel will reach the same conclusion."

The union's attorney had a more vehement reaction to the city's recent reform proposals. Peter Hoffmann of the San Francisco-based firm Rains, Lucia, Stern, PC, claimed in a Feb. 1 letter that the city's focus on employee concessions "raises significant legal challenges" and will "likely perpetuate the gross inequity established under the so-called '90/10 plan.'"

The biggest concerns come from the city's longest-serving employees, who have long been banking on having the city fund their health care after retirement. Many are concerned that if active employees accept concessions on health care, these concessions would trickle down to retirees.

Hoffman took issue with a recent report from the city, which states that "a few active employees under the 90/10 plan have expressed concern that in the future, the city benefit may be renegotiated to a lower employer contribution, which would flow to retiree medical as well."

"Contrary to the city manager's suggestion, there are more than 'a few active employees' that have expressed their concerns," Hoffman wrote. "Indeed the number would be much closer to 'all of them' -- particularly among the city's longest-tenured employees who stand to see their promised retirement benefits eliminated, just as they approach the end of their careers."

Hoffman called the report "little more than a feeble attempt to begin preparing for the anticipated legal challenge."

Management has disputed the union's claims about predetermined outcomes and insufficient engagement. At the Feb. 4 meeting, Keene was adamant about the fact that no decisions have been made and that staff has been approaching the unions in good faith and with the understanding that any deals would have to be made through the bargaining process. But he also said that the city is committed to having more cost-sharing between the city and its employees -- both active and retired.

The drama will play out at the bargaining table in 2013 and 2014. While council members have encouraged staff to hold forums and conduct more outreach in hopes of easing the pain for employees, staff acknowledged at a recent discussion that when it comes to health care concessions, there really is no easy way to have a conversation.

"I think the difficulty is going to be that consideration of greater contributions by employees, or sacrifices, are difficult conversations for people to have," Keene said Feb. 4. "To sort of say, 'I like that meeting. Let's do that again' -- it's not that pleasant."

See full-size images of the story's accompanying graphics:

City of Palo Alto health care expense.

Comments

Mountain View

on Mar 22, 2013 at 10:37 am

on Mar 22, 2013 at 10:37 am

Hey - wouldn't it make sense to look at the issue of health care as providing a means for employees to care for their health as needed. People in lower pay classifications should be paying the least for their own coverage, those in the upper pay brackets should be paying the most. Perhaps the number of dependents needing coverage could be factored in as well. Is it rational for someone making something like $150,000 to be getting coverage for the same contribution as someone making less than 50,000? Perhaps there should be an upper limit, such as if you're making more than $175,000 you buy your own coverage. Same thing could be applied to retirees.

Just an idea.

Another Palo Alto neighborhood

on Mar 22, 2013 at 10:50 am

on Mar 22, 2013 at 10:50 am

It's high time we got away from defined benefit plans to defined contribution plans. Corporate America did it in the 80s. We're 30 years behind but it needs to be done. We should have a known liability today for services delivered today. The idea that we should have an undefined liability for defined services makes no sense.

Let's get our city aligned with the current realities we all live with.

College Terrace

on Mar 22, 2013 at 1:11 pm

on Mar 22, 2013 at 1:11 pm

The private sector has solved this problem, because it's not able to keep kicking the can down the road like government. If the public sector can't solve this, services need to be outsourced to the private sector as soon as possible.

Another Palo Alto neighborhood

on Mar 22, 2013 at 2:30 pm

on Mar 22, 2013 at 2:30 pm

The insurance companies need regulation. The raise their rates horribly to individuals and small businesses, and they do it annually. We have had our coverage downgraded twice because it saves the employer money, but costs us an arm and a leg. The insurance companies have huge profits and do not mind allowing people to die to continue them.

The hospitals and their administrations also make ridiculously huge profits, especially the non-profit ones who pay no tax ( see TIME mag from two weeks or so ago). It is absolutely criminal what they charge the public and the insurance companies. THEY need regulating immediately, as they have sick people totally over a barrel!

The pharmaceutical companies raise the rates of their drugs once or twice a year. My medicine for rheumatoid arthritis has gone Fromm $350/mo to $2800/mo in just four years! My copay is now Nearly $1000/mo, yet if I stop taking the shots, I will become crippled and unable to work. Cheaper drugs have been far less effective Nd do nothing to inhibit disease progression. Again, they have sick people over a barrel, and THEY need some regulation.

Duveneck/St. Francis

on Mar 22, 2013 at 2:58 pm

on Mar 22, 2013 at 2:58 pm

@Madame de l'Enfer - You think insurance companies aren't heavily regulated?

Spend some time here at the California Dept. of Insurance site - all those rate increases you see get the government stamp of approval.

Web Link

And it is no coincidence that the biggest hikes in rates have come after the biggest moves to regulate the industry over the last 4 years.

Another Palo Alto neighborhood

on Mar 22, 2013 at 6:01 pm

on Mar 22, 2013 at 6:01 pm

Health care costs in the USA are a disaster and the Time piece, "Bitter Pill" by Steven Brill, ought to be required reading for everybody.

That said, the Paly Online article's title, "City vs Labor," is a misnomer. Private-sector unions may still be Labor, but public-sector ones aren't; they're political organizations, kind of for-profit super-PACs, whose only real function is to transfer ever more cash from everybody else to themselves. Having the rest of us protect them from the healthcare tsunami is just one more, very disturbing, front in the War on Residents.

Another Palo Alto neighborhood

on Mar 22, 2013 at 7:24 pm

on Mar 22, 2013 at 7:24 pm

I have had to engage the California State Insurance Commisioner's office before....when my then-insurance company tried to keep me from the medication I desperately needed. I was told that the insurance company HAD to respond to them.....they would charge and fine them a whopping $200/day for not responding.

That really must have hurt the insurance company, because they took 20 working days to respond to the Insurance Commissioner!

They are completely ineffectual and useless! They ended up blaming our insurance broker!

Barron Park

on Mar 22, 2013 at 9:34 pm

on Mar 22, 2013 at 9:34 pm

Congratulations Palo Alto Weekly for your continued one sided smear on Palo Alto employees and desire to perpetrate resident ire. Employees are apparently a lesser class of humans for the Palo Alto Weekly, and perpetrates the "noblesse oblige".

Former council member and Palo Alto resident Yoriko Kishimoto left after PT work on council with $1,800 a month in healthcare benefits for life after telling employees " they just needed to tighten their belts".

Our city manager Jim Keene makes over $300,000 a year. Plus a home financed by the City of Palo Alto.

We have no oversight or board for for hiring top managers who move themselves up the ladder based on their "good old boy buddy system". Face it it's like a private club.

Managers continue to return to the city after retirement to double dip.

We call ourselves "green" when we refuse to provide affordable housing for police, fire, and civic employees who commute 1/3 hour to 2 hours to work?

Congratulations Palo Alto Weekly. You have succeeded in lauding the entities that support you: Overpaid city management, Real Estate sales , developers, and oppressive prop 13ers on a fixed income with multimillion dollar homes.

College Terrace

on Mar 22, 2013 at 10:40 pm

on Mar 22, 2013 at 10:40 pm

It's long over due for Palo Alto, and most cities, to stop the excessive benefits lavished on it's employees. Defined benefit pensions, health care, or just about anything have all proven to be excessively costly to tax payers. It is unfortunate, but a reality of the world today. Palo Alto city govt is teetering on basically existing to fund their pensions. This is not right. Scrap the defined benefits plans, all of them, and switch to a defined contribution system. Sadly, even those are plans are becoming scarce, but again, the world has changed. It's time for local govt employees everywhere to pay their fair share for their retirements and health care. I do.

Midtown

on Mar 22, 2013 at 11:52 pm

on Mar 22, 2013 at 11:52 pm

The Palo Alto Weekly failed to talk about how the city failed to address this problem from 2006; Here is the proposal from city management in November 2006: Web Link

They proposed enriching the retirement benefit from 2%/55 years (ie. 2% per year worked, retire at 55) to 2.7%/55 years in exchange for modifying what the city pays for medical benefits. So an employee who use to get 60% of their salary for working 30 years and retiring at 55, instead gets 84% of their salary.

Well, this was probably the worst deal of all time, as pension costs have skyrocketed and as this article highlights, the city still faces a problem with medical benefits payments. The vote on the city council was 6-3, the six in favor were: Larry Klein, Barton, Beecham, Cordell, Drekmeier, Morton; the 3 against were Kishimoto, Kleinberg & Mossar.

Barron Park

on Mar 23, 2013 at 12:23 am

on Mar 23, 2013 at 12:23 am

...and Kishimoto retired with 1,800 a moth in healthcare for herself. How heroic.

Barron Park

on Mar 23, 2013 at 12:40 am

on Mar 23, 2013 at 12:40 am

Keene brougth this on himself. The weekly repeating city press releases doesn't explain that the rash of retirees was due to a change in city policy - the city made employees pay for their healthcare out of their pension DURING retirement if they didn't retire by a certain date. Yes, Keene brought this on himself and the city coffers.

"The city's ratio of early retirees to actives is so high that it is a barrier to obtaining coverage quotes from the open market, based on input from insurance representatives," the report states. "Early retirees incur higher health care costs compared to active employees, which insurers specify as a reason to charge higher insurance premiums."

What makes matters worse is that many of these retirees have just left and remain too young to qualify for Medicare, a factor that further ups the city's costs. Of the 860 retired employees, 377 are "early retirees," according to the report. Things are likely to get worse before they get better. According to Shen, about half of the city's workforce is set to retire in the next decade, further expanding what Keene called the city's "shadow organization."

Professorville

on Mar 23, 2013 at 2:02 am

on Mar 23, 2013 at 2:02 am

Well I've had several interactions with city workers of late. Basically I have to start by apologizing to be a citizen of Palo Alto and try to distance myself from the disgusting attitudes and stances as evidenced by the Palo Alto Weekly and it's Ann Ryand minions. And when I do, boy ya all did create a ton of ill will and contempt. Yea reap what ye sow! Ditto for police officers.

Fairmeadow

on Mar 23, 2013 at 9:36 am

on Mar 23, 2013 at 9:36 am

Umm...them more regulations/mandates our Feds put on our medical insurances, the more it costs us to insure and the more it costs in care.

Search the New York Times article on the San Diego Bakery which will lose half its profits because of the mandates of Obamacare and is now faced with the 3 choices: 1) Lay off enough workers from 95 to 49 to get under the magic 50 number 2) Pay the penalty for not insuring, which is more than insuring or 3) bring down full-time employees to the magic number of 29 hours per week to not have to comply with the new law.

Mind you, before Obamacare, these employees had insurance, and jobs...but with Obamacare, the mandates are so immense the costs rise to eat up 1/2 the profits the bakery now makes.

Great job, folks. Good luck. We will all suffer from the kindness of the Dems on this one, and I have no idea how public employees will fare and how we, the taxpayers, will bear the brunt as we lose our jobs or hours.

Another Palo Alto neighborhood

on Mar 23, 2013 at 9:56 am

on Mar 23, 2013 at 9:56 am

> Basically I have to start by apologizing to be a citizen

> of Palo Alto and try to distance myself from the disgusting

> attitudes and stances as evidenced by the Palo Alto Weekly

With all this hovelling and grovelling .. where did you find the time to actually discuss your problem with the City employees that you seem to rever so much?

When did City employees shift from being "servants of the people" .. to their "overlords"?

Another Palo Alto neighborhood

on Mar 23, 2013 at 9:58 am

on Mar 23, 2013 at 9:58 am

> Search the New York Times article on the San Diego Bakery

San Diego-based businesses can always relocate to Tiajuana .. and kiss ObamaCare goodbye.

Duveneck/St. Francis

on Mar 23, 2013 at 10:52 am

on Mar 23, 2013 at 10:52 am

>> Basically I have to start by apologizing to be a citizen

>> of Palo Alto and try to distance myself from the disgusting

>> attitudes and stances as evidenced by the Palo Alto Weekly

>With all this hovelling and grovelling .. where did you find the

>time to actually discuss your problem with the City

>employees that you seem to rever so much?

>When did City employees shift from being "servants of the

>people" .. to their "overlords"?

Seriously, the attitudes and the cost can be replaced with private contractors.

Barron Park

on Mar 23, 2013 at 1:28 pm

on Mar 23, 2013 at 1:28 pm

Yes Palo Alto Weekly - love the illustration!

You have succeeded in planting the continued hostility and ire of the community on the least paid public employees, as if public services should be for free and the overpaid city management club that gifts itself jobs, benefits, and double dipping after retirement - must be a great leadership.

Why is it that Mountain View and Sunnyvale do not treat employees like dirt in the media, and the BEST SKILLED PALO ALTO EMPLOYEES are leaving and going to better places, or retiring early?... Retiring early, and leaving Palo Alto with the bill for their retiree healthcare

rather than having them employed in Palo Alto with their full range of skills and knowledge working FOR PALO ALTO?

How is losing your best employees and "knowledge base" INNOVATIVE?

Can we expect another season of the same pandering of the Weekly to the creation of a hostile city environment, and the failure of the Weekly to acknowledge the economic and cultural value of skilled, dedicated, and knowledgeable employees?

Midtown

on Mar 23, 2013 at 3:27 pm

on Mar 23, 2013 at 3:27 pm

Here’s the TIME article plus 2 others:

Bitter Pill: Why Medical Bills Are Killing Us Web Link

Pharmaceutical Companies Spent 19 Times More On Self-Promotion Than Basic Research

Web Link

We spend $750 billion on unnecessary health care. Two charts explain why.

Web Link

Fairmeadow

on Mar 24, 2013 at 6:56 am

on Mar 24, 2013 at 6:56 am

Pat: Ask yourself WHY it is more profitable to NOT create new medicines now...

Ask yourself WHY there is so much wasted time and resources in medical care.

Ask yourself WHY medical care costs have risen so much in the last 30 years.

I have been in medical care for over 30 years and have seen why. The constant fear of silly lawsuits make us protect ourselves by ordering many more tests than are necessary. The bills for liability insurance keep rising. The federal and state regulations on documentation keep rising so that more time is spent documenting than treating.The pay for each patient keeps lowering, if not in actuality, in practice as the pay scales stay the same and inflation continues. Patients have become highly divorced from the actual costs of care, gone are the days of each person having to pay "per visit" a fraction of their costs, encouraging them to choose wisely ( which is why the PPO model works so well, but this is disappearing.)

What does that mean to us, in the medical care fields? How can we survive? We have to see more and more patients for less and less time per patient, but still using expensive tests to treat them...or simply not see them and not test them.

The result is, frankly, less care per patient.

How to fix it?

It is not yet MORE mandates and regulations and price controls. It is the opposite, let people choose the level of care they want to contribute to, not force them, as now, to choose between cadillac or nothing.

It is tort reform to protect us, the medical care providers, lower our cost, give us back the professional ability to help patients decide what next with our knowledge and wisdom, without expensive tests to back us up.

It is putting the patient in the middle of choosing what care he will get by putting at least some of the cost choices into his pocket.

It is greatly lowering the horrific paper work/computer work requirements to allow us to see more people in a day.

As for medicines: Give pharmaceutical companies back the profit incentive to create new medicines, and they will. There is little profit to be made in creating such life saving medicines as warfarin or quality of life medicines as amlodipine any more. So we will have less innovation. And we will suffer more than needed.

In the meantime, we keep rolling down the tracks to a trainwreck, aka French style medical care. If we had a brain, we would learn from the mistakes of others who have gone this route before us, but we are arrogant and think that somehow, we are smarter than all the people and countries before us who have been there, done that, and now are failing.

I recommend reading anything by Sally Pipes to understand the roots of what works, and how to pull out of the mess we have created.

In the meantime, we are stuck dealing with skyrocketing costs and lowered medical care, not only for each of us as private citizens in the private world, but for our public employees. A heavy, heavy burden.

Another Palo Alto neighborhood

on Mar 24, 2013 at 11:14 am

on Mar 24, 2013 at 11:14 am

Private sector employees pay for health insurance, and they are on their own when they leave the employer, including retirement. Why shouldn't it be the same for government employees (including managers and administrators)? Why do taxpayers have to pay for benefits they themselves don't get?

The issue isn't whether government employees are good people -- it is just that their benefits are totally unaffordable, and it is time for them to pull their own weight, like those in the private sector.

Midtown

on Mar 24, 2013 at 12:05 pm

on Mar 24, 2013 at 12:05 pm

I agree that medical care is a disaster for many reasons. But I take issue with this statement: “Give pharmaceutical companies back the profit incentive to create new medicines, and they will.”

Did you not read the article I posted, “Pharmaceutical Companies Spent 19 Times More On Self-Promotion Than Basic Research”?

Just how much profit does a pharma need to make? “In Forbes’ list of the world’s leading companies, pharmaceutical companies have profit margins averaging 20 percent, whereas the average profit margin for the 2,000 leading companies worldwide is 8 percent.” Web Link

Check out Fortune’s 2012 list: Web Link

And how much goes into lobbying? “The pharmaceutical industry as a whole spent $69.6 million on lobbying in the first three months [of 2012] alone.” Web Link

Sally Pipes is part of the Pacific Research Institute for Public Policy (PRI), a politically conservative “free market think tank” which promotes “the principles of individual freedom and personal responsibility" through policies that emphasize a free economy, private initiative, and limited government. It has been associated with the American Enterprise Institute, The Heritage Foundation, The Fraser Institute and the Cato Institute.

Another Palo Alto neighborhood

on Mar 24, 2013 at 2:26 pm

on Mar 24, 2013 at 2:26 pm

> Did you not read the article I posted, “Pharmaceutical Companies

> Spent 19 Times More On Self-Promotion Than Basic Research”?

Is this necessarily a bad thing? The Pharmaceutical companies have to see the medicines that they have created. How do you do that without “self-promotion”?

But, let’s ask another question—just how many more medicines need to be developed? Presumably there is some sort of drug registry which we could interrogate in order to learn an answer to that question? How many do we have now—and how many do we need to develop, say, every five years?

And of course, how much does it cost to develop a new drug? Do the Pharmaceutical Companies have an obligation to provide the cost of developing a drug for the market to the public? Let’s suppose that most drugs cost at least $100M to bring to market. Why would anyone want them to loose money on any of their drug/medicine offerings?

Another Palo Alto neighborhood

on Mar 24, 2013 at 3:57 pm

on Mar 24, 2013 at 3:57 pm

Here's some data about drug development costs--

Web Link

Another Palo Alto neighborhood

on Mar 24, 2013 at 4:37 pm

on Mar 24, 2013 at 4:37 pm

Whatever you may think of Keane, the wave of "early retirees" isn't his fault; it's the fault of previous city staff and councils who allowed themselves to be maneuvered into contracts which allow ridiculous retirement and benefit packages. Trying to get control of this stuff is just a trigger for things already building for some time. But when you're in a hole, you've got to stop digging.

The real problem is the public-sector perversion of "retirement." A retirement plan for most people is something to support you when you're too old to work. But for the public unions --- and their management --- "early retirement" is just a mooch. Only in the public sector is it a way to get two paychecks for one job, or free healthcare plus one paycheck for no job. All paid for by your same-age-but-still-working, paid-less-for-equivalent-work, future social-security-recipient neighbors; and given to you not by Keane, but by previous city councils and their -- surprise! --- public union contributors.

Community Center

on Mar 24, 2013 at 7:22 pm

on Mar 24, 2013 at 7:22 pm

I don't get it. The cost of excessive, though admittedly very desirable, benefits exceeds the future capacity of Palo Alto, and most likely just about every city/town in the state. It's time to scrap the defined benefits program for a defined contribution benefits program. What's the dilemma?

Los Altos

on Mar 24, 2013 at 9:59 pm

on Mar 24, 2013 at 9:59 pm

I tried to pay more taxes on our home, but they won't let me...guess we just lucked out and bought at the right time. It is also so unfortunate that we bought the home in '70 for 90k, but now it is worth 2.5m guess that says alot for staying power...

Bitter--party of one?

Another Palo Alto neighborhood

on Mar 25, 2013 at 2:40 am

on Mar 25, 2013 at 2:40 am

We are sitting here arguing over the crumbs, when the way to make a MUCH bigger pie, so to speak, is staring us in the face from all over the advanced world. One has to wonder how hungry we have to get before we decide to get some sense.

The biggest cut we could make with no harm — in fact, it would benefit us — is to simply end investor-owned health insurance and restrict healthcare underwriting to non-profit insurance and consumer-beneficial models of insurance (similar to credit unions). This gets to the root of the biggest corrupting incentive in the system overall.

When insurers have to pay investors,

1) ***they profit based on a percentage of the overall healthcare economy***, so, the larger that economy is, the more money they make, i.e., for-profit insurers have no incentive to save us money, in fact their incentive is to have as large a healthcare economy as we can bear (surprise! it always is). The Healthcare Affordability Act doesn't solve this.

2) In order to CONTROL the system the way they need to maximize their profits, for-profit insurance fosters a bureaucracy that costs us on the order of HALF TRILLION DOLLARS ANNUALLY (on the order of the pre-war department of defense), i.e., denials today are mainly the result of a need for control to benefit insurers, not to control costs for the system overall. This administrative burden adds to every healthcare dollar spent and pervades the system, there's no way to "opt out".

3) In their need to CONTROL the system, with lack of any incentive to control the overall cost of the system, insurers often end up hurting the advancement of medicine and underwriting more expensive treatments that they can control over less expensive ones they can't. This favors consolidation of care, which in turn makes bigger healthcare players who don't have to compete and can leverage more money. For example, insurers will favor certain pharmaceutical interventions, where they only have to deal with a few large pharmaceutical companies, over paying for a care service involving thousands of individual providers across the nation, even if the latter is better for patients, and the former is more costly, because they can predict the costs with fewer players better and can more easily negotiate for control. Remember, they aren't out to make the system less expensive, just control it best to maximize extraction of their profits. A previous poster has mentioned the precipitous rise in pharmaceutical costs in the last few years -- it was predictable, as dramatically inflated pharmaceutical prices give insurers a buffer for better control in a situation where it's now even more difficult to maximize their profits.

3) In order for non-profit insurers to compete when for-profits dominate, non-profits have to play the same cherry-picking games that feeds into the overall bureaucracy and administrative costs. Our own system worked far better when our own system was dominated by non-profit insurers, the serious price soaring began when for-profit insurers began to dominate.

Please note: I am NOT advocating single-payer or non-profit healthcare delivery!

Currently, no other first-world nation allows for-profit insurers except the US. None of them pay even close to what we pay for healthcare administration, which in our system is so costly largely due to private for-profit insurers. Every other first-world nation pays less per capita, covers everyone, in many cases get better outcome, and in some cases have MORE privatized systems than ours, more advanced care for most people, and far more perks and freedom in their care now.

Let me repeat that, in some cases, those other systems have MORE privatized systems than ours. I don't understand why some people can't get that you can have healthy, productive efficient non-profit sectors in a thriving, privatized, market-based system. I remember discussing this issue with a neighbor, who kept insisting it wasn't possible to do, then he suggested we should have a system like Germany's -- not realizing that Germany also has all non-profit insurance, too, within a more privatized system than ours.

As T.R. Reid pointed out in this book The Healing of America, Switzerland, with a more privatized system than ours, tried allowing their insurers to profit in healthcare underwriting, and costs began skyrocketing and people going bankrupt. So they held a referendum, stopped the profiteering in health insurance, and solved the skyrocketing costs and bankruptcies.

This is low-hanging fruit that is choking us to death! It's a change that must be made before any other improvements could possibly make a difference, it's the ever-growing elephant in the room that threatens to kill us, yet we cling to it like we can't live without it. When are we going to decide that retaining a certain kind of insurance investment opportunity isn't worth bankrupting our nation? Healthcare is now 20% of our economy! It's painful to think about what will be cut instead.

I realize we can't solve this particular issue by making changes locally -- or can we?...

Crescent Park

on Mar 25, 2013 at 9:53 am

on Mar 25, 2013 at 9:53 am

@prop13er

Just sell your house and buy another one. Then you'll be paying more tax.

Crescent Park

on Mar 25, 2013 at 11:36 am

on Mar 25, 2013 at 11:36 am

Is it really so bad that a lot of folks will work into old age with no possible retirement if it helps provide our public employees with the best in compensation, early retirement and lifetime healthcare?

Menlo Park

on Mar 25, 2013 at 12:01 pm

on Mar 25, 2013 at 12:01 pm

Make -

If a person is working into old age with no possible retirement, it's because of reasons far beyond the incremental added cost to their property tax bill due to public employees.

Let's maintain some perspective here and not blame public employees for everything that's wrong in our local economy. After all, Wall Street transgressions contributed far more to the economic collapse that we're all dealing with than public employee compensation ever could.

Palo Verde

on Mar 25, 2013 at 12:25 pm

on Mar 25, 2013 at 12:25 pm

Wow. This looks like a gold mine. I should empty my credit union 0.60% APY fully-taxable savings account and buy shares of health insurance companies and big pharmaceuticals for the tax-advantaged dividends and capital gains.

Crescent Park

on Mar 25, 2013 at 12:29 pm

on Mar 25, 2013 at 12:29 pm

It's disingenuous to refer to Wall Street as a bigger problem.

Cities and towns in Ca and the rest of the US are declaring bankruptcy or contemplating bankruptcy because of public employee comp obligations that cannot be sustained.

We all pay more in fees and taxes here in PA to support our city employee comp, and we also forgo infrastructure maintenance because of a shortage of funds. These are not problems caused by Wall Street. Although many muni bonds will be downgraded by Wall Street if more communities default on their bond obligations in the future.

If you are unaware of the key roles Fannie and Freddie played in our financial problems by pressuring for quotas of sub prime loans you should find out.

Woodside

on Mar 25, 2013 at 12:32 pm

on Mar 25, 2013 at 12:32 pm

Our public servants are quite underpaid. We must take more money from our citizens to give our public servants what they deserve. Consider:

Web Link

Another Palo Alto neighborhood

on Mar 25, 2013 at 12:34 pm

on Mar 25, 2013 at 12:34 pm

> Let's maintain some perspective here and not blame public

> employees for everything that's wrong in our local

> economy. After all, Wall Street transgressions contributed

> far more to the economic collapse that we're all dealing

> with than public employee compensation ever could.

This is a fair point—up to where it turns out that the Government is siphoning off too much of the GDP for its wealth redistribution programs.

The US has been undergoing de-industrialization since the day after the end of WWII. The East/Midwest (Rust Belt) has seen the worst of it all. As the so-called 3rd World economies began to come on line, core industries—like steel, merchant marine, and auto manufacture started moving to Germany, Japan, and then other countries, like South Korea. The Unions never understood that this. The continued to see the American Manufacturing Sector as “the enemy”—to be destroy at all costs.

The guys never quite seem to get picture that once they destroyed the American Manufacturing Sector—that they would lose their jobs at the same time.

Starting around 1970, Labor Union latched onto the Government Sector—driving up the costs of labor, and driving down productivity.

Before Obama—“government” was consuming about 40% of the US GDP. After Obama—that percentage has jumped to 50%, and may well continue to creep up if Democrats continue to prevail at the National level.

While “government” does recycle money that it extracts for the productive people in our society—giving it to the less productive members, there is only so much money to go around. We have managed to create unfunded debts that range (estimates) from $120T to $200T. These debts are mostly to fund wealth redistribution—not building infrastructure, or providing essential government services.

So—it’s not hard to see “government” as more of a burden on the local economy than a benefit.

Crescent Park

on Mar 25, 2013 at 12:52 pm

on Mar 25, 2013 at 12:52 pm

Jos Davis,

By what standards do you conclude our public servants are 'quite underpaid'?

Look at the PA Weekly City of PA salary and comp report just published. Firemen and policemen making around $200,000 annually PLUS health and retirement benefits is underpaid?

Only a public employee union member could think that is underpaid.

Another Palo Alto neighborhood

on Mar 25, 2013 at 1:15 pm

on Mar 25, 2013 at 1:15 pm

This morning Daily Post carried a story about the California Courts System trying to put its records on-line, starting back in 2004. This project ballooned to an estimated $2B to complete, and last year the Office of the State Auditor recommended that this project be terminated. Down a bit in the article, the Post states: “Labor unions have been a driving force against the massive project ..”.

Why this project go so out-of-hand is difficult to know, but California has failed in a number of HighTech projects, over the years. So—California State Government technology management is the first culprit. The Unions probably are not one of the key factors in the Courts System failure—but it’s hard to believe that they weren’t trying to sabotage it from its inception. Now, the Courts want to charge $10/file—which will have a very chilling effect on investigative journalism, and ultimately, the public’s “right to know”.

We can thank the Labor Unions for this attack on the public’s “right to know”—since they will probably be very happy with this new records-access charge, and will no doubt be pushing to double it every couple of years!

Menlo Park

on Mar 25, 2013 at 1:41 pm

on Mar 25, 2013 at 1:41 pm

Make -

I don't think I'm being disingenuous at all. The cities & counties are in a pickle because their tax receipts have plummeted as a result of the Great Recession brought on by Wall Street shenanigans. In addition, their employee costs have risen because CALPERS has had to charge them more to cover pension & healthcare costs as their investment returns haven't returned to pre-2008 levels.

Both reduced tax receipts and reduced investment returns are directly linked to the market collapse caused by Wall Street. Beyond that, you probably weren't complaining 15 years ago when the city essentially stopped contributing to employee retirements because CALPERS' returns were so good that they temporarily discontinued employer contributions. If the city had been wise, they would have put that saved money into a rainy day fund to cover the present predicament.

As for your claim that the recession was caused by Fannie & Freddie's easing of credit requirements, that canard has long been disproved. Don't keep repeating nonsense when it can easily be checked for accuracy. Try this link Web Link or the Wikipedia artcle Web Link

Another Palo Alto neighborhood

on Mar 25, 2013 at 2:36 pm

on Mar 25, 2013 at 2:36 pm

> I don't think I'm being disingenuous at all.

Really? You don’t seem to have much of a hold on the economic realities of the past fifty years, or so!

> The cities & counties are in a pickle because

> their tax receipts have plummeted as a result

> of the Great Recession brought on by

> Wall Street shenanigans

There is a grain of truth in this statement, but only a grain. Most of us have to live within our means. Government, on the other hand, seems to have come to a belief that it can spend as much as it wants—simply raising taxes on people.

Government revenues come from numerous sources—property taxes, income taxes, various fees/fines, and so on. These sources are variable. However, government spending has been on auto-pilot for decades now. So, when most of us run out of money—we blame ourselves, and stop spending. Governments (increasingly meaning government workers unions) don’t seem to think that they should take pay cuts when there is not sufficient revenues to pay their ever-increasing salaries. Big difference between those who think that they have a right to a guaranteed job, a guaranteed salary, no pay cuts, and a guaranteed pension after retirement (including health care, in some cases).

> As for your claim that the recession was caused by

> Fannie & Freddie's easing of credit requirements,

Fannie/Freddie played a part—but the mess is far more complicated that that. It involved massive fraud on the part of people from local real estate brokers/salesmen through Wall Street. Additionally, Congress voted, in one way or another, to permit Wall Street to act the way it did. Remember—so far no one on Wall Street has been indicted, or convicted, of any crimes. You can thank your local Congressperson for that!

Barron Park

on Mar 25, 2013 at 3:41 pm

on Mar 25, 2013 at 3:41 pm

Palo Alto employees are overpaid and receive too many benefits and their pensions are outrageous. The city should fire them all and outsource the work to a public company.

The City Council needs to stop stealing money from the residents to overpay these people.

Worry about the exploding crime rate in downtown Palo Alto, the excessive utility costs for living in Palo Alto, and the rediculous expansion of buildings and buisinesses in Palo Alto. There is no more parking donwtown. Two of the last three times I went downtown for lunch I could not find a parking place in 15 minutes and went to Mtn. View to ear. Its rediculous. Stop having these illusions of grandure and start working for the residents.

Another Palo Alto neighborhood

on Mar 25, 2013 at 4:26 pm

on Mar 25, 2013 at 4:26 pm

I think Joe Davis was being ironic. As for Steve from Menlo Park, I think he needs to learn to use a calculator.

Palo Alto has an unfunded public pension liability of $500 million or so. The public unions, and their management, howl that by their calculation it's only $300 million. Oh, no problem then.

Steve from MP thinks the problem is Wall Street. Not for example, the Fire Union (basically EMTs nowadays)? Who retire at 55 with a six figure pension, not including health care? Over say 30 years, that's $3.6M each, ultimately out of the General Fund, partially supported in Palo Alto by ... wait for it ... CPAU. Lehman and Bear didn't give them that deal. Maybe Steve from MP has $3.6M in his 401K so it doesn't seem like so much.

Wackenhut's new name is G4S Government Services. Their web site is Web Link Let's outsource.

That would help with Fire, but the rest

Barron Park

on Mar 25, 2013 at 5:12 pm

on Mar 25, 2013 at 5:12 pm

This is ridiculous. Except for the police, who actually earn their money, cut all of their pay in by 40% to compensate for the ridiculous benefits. When the unions refuse, impose the contract or start outsourcing.

Menlo Park

on Mar 25, 2013 at 5:20 pm

on Mar 25, 2013 at 5:20 pm

Wondering?

I agree with you that Congress & the White House were responsible for the deregulation starting in the 1990's that contributed to the excesses on Wall Street that produced this Great Recession. I also agree that it's a shame that no one from Wall Street has been indicted, let alone convicted, of these crimes that have hurt so many millions of Americans and permanently scarred the futures of our young people. It's a shame that Anna Eshoo supported repeal of Glass-Steagall, if that's who you're referring to. I expect this is a vote that she regrets in hindsight. I doubt the Phil Graham, the author of the repeal, has any such qualms.

However, I don't agree with your overly broad indictment of government in general. When applied to Palo Alto specifically your criticisms are off base and, often, flat-out wrong:

> Governments (increasingly meaning government workers unions) don’t

> seem to think that they should take pay cuts when there is not

> sufficient revenues to pay their ever-increasing salaries. Big

> difference between those who think that they have a right to a guaranteed job, a guaranteed salary, no pay cuts, and a guaranteed

> pension after retirement (including health care, in some cases).

The facts are that, in response to the fiscal crisis, Palo Alto cut 20 city positions in 2009, 40 more in 2010, and another 29 in 2011. Web Link

In 2010 Palo Alto restructured Employee Pensions and Healthcare benefits to make them less generous.

In 2010 Palo Alto reduced employee pay and reduced employee benefits.

All these restructurings and reductions in pay & benefits were achieved in consultation with the employees through their unions.

Claiming that city employees have not cuts & reductions as the city has worked to balance its budget is just not accurate.

Menlo Park

on Mar 25, 2013 at 6:01 pm

on Mar 25, 2013 at 6:01 pm

Resident -

"Maybe Steve from MP has $3.6M in his 401K so it doesn't seem like so much."

Steve from MP wishes he had one tenth that amount in his 401K so yes, that does seem like a lot.

Where I have trouble with your complaint (ignoring the snide calculator comment for the moment) is that you don't seem to understand that PA employees get their retirement checks from CALPERS, not from Palo Alto. 64% of each pension check comes from CALPERS earnings on their investments. Only 21% comes from the employer contributions with the remaining 15% coming from the employee contributions.

Your $500 million unfunded liability probably comes from the Stanford study, which used standards appropriate for commercial pension plans that call for near 100% funding. This is appropriate because companies can fail and the money needs to be there to cover the retirement needs of the company's current & retired workforce. Public pensions in contrast are generally considered fully funded when they are able to cover 80% of liabilities since, like Social Security, there is always going to be a large contingent of active government workers (teachers, police, firemen) and their employers who are contributing to the fund. Not sure why the Stanford study ignored this basic difference except that the headline looks a lot worse the way they chose to do it.

Another Palo Alto neighborhood

on Mar 25, 2013 at 6:34 pm

on Mar 25, 2013 at 6:34 pm

Palo Alto can't afford its infrastructure and upkeep, never mind new parking garages etc. Even now the City has an crew of consultants trying to figure out how to get another bond measure past the residents next year. Maybe the Cypress banks will underwrite it.

The City's ability to restructure its contracts is constrained by massively irresponsible contracts between previous city councils and the same public unions who funded their election campaigns; and some of whom been pretty darn militant for rich guys. What reforms we have so far are baby steps. Public pension and healthcare costs are still eating more and more of the city's budget, as Sheyner article discusses. The really hard work is still ahead.

It's worth noting that this is -relatively- recent. The public-employee hockey stick boondoggle really took off around the time of Gray Davis. Public pensioners from 30 years ago aren't the problem, and have plans comparable to everybody else.

But today ... it's astonishing that anybody could think it's right for a secretary in the private sector to work for $30K a year until he's 65 and then get Social Security, so he can pay for another one in the public sector to work for $50K a year until he's 55, plus big spiffs like infinite vacation accrual and sick time for days when he's not sick, and then get a retirement plan worth many times more than Social Security. Steve, do you really think this is ok? That so many public sector employees actually do think so is the sign of a massive culture dysfunction.

Although if you go into Safeway and ask a Menlo Park firefighter whether he's on regular time or overtime, he'll sort of look at the ground when he says, "uh, regular time."

Old Palo Alto

on Mar 25, 2013 at 9:23 pm

on Mar 25, 2013 at 9:23 pm

To resident: You can tell which Firefighter (at Safeway) is on overtime. He/she is the one buying dessert.

Another Palo Alto neighborhood

on Mar 26, 2013 at 12:32 pm

on Mar 26, 2013 at 12:32 pm

> The facts are that, in response to the fiscal crisis, Palo Alto

> cut 20 city positions in 2009, 40 more in 2010,

> and another 29 in 2011

The link provided to the City budget is not all that helpful. Can you provide page numbers to the section that documents this point?

The City documented over 1560 Full/Part-time employees for the 2012 financial year. A cut of 30 positions a year is not even 2% a year. “Cuts” in the real world are rarely this benign. It’s not hard to find news reports where whole companies have disappeared—for reasons varying from bad management to unsustainable union demands—like the collapse of the Hostess Food Company (Twinkees/Wonder Bread) in 2012.

It’s very difficult with this sort of information to determine how many of these positions were “cut”, how many were replaced with reorganization, and how many were “deadwood” terminations.

> Claiming that city employees have not cuts & reductions

> as the city has worked to balance its budget is

> just not accurate.

Clearly the City did ask the employees to carry more of their own benefit package. But comments from various sources made it clear that a majority of the employees were not happy about. And let’s not forget that often when government employees take a “cut”—they manage to get the lost money back, one way or another. So, in the long run, “cuts” to these people is just a deferral.

In terms of this post-retirement health care, why should the taxpayers be paying for retired employees who are on pensions that push the $100K mark?

The following reports on a Contra Costa County Supervisor who will be paid over 400K, every year, for the rest of her life:

Web Link

Why should anyone in “public service” to paid this much, and for life?

The whole system is out-of-kilter, and needs reform, as quickly as possible.

Downtown North

on Mar 26, 2013 at 1:38 pm

on Mar 26, 2013 at 1:38 pm

Public sector unions should be banned. FDR, himself a stong union supporter, opposed them. Public sector unions are monopolies of critical public services. They would not pass muster under anti-trust regulators, if they were not protected by leftists.

We are reaping what we have sown. Actually not me, but all the leftists I am obliged to live with in Palo Alto. this problem in not going away, but it should never have occurred in the first place.

Menlo Park

on Mar 26, 2013 at 2:48 pm

on Mar 26, 2013 at 2:48 pm

Wondering -

You wrote

"Clearly the City did ask the employees to carry more of their own benefit package. But comments from various sources made it clear that a majority of the employees were not happy about."

Excuse me but aren't you asking a bit much that employees should not only take a cut in their benefits and pay more for them but that they should also be happy about it?! What difference does it make to you if they're happy or not? The important thing, from the point of view of balancing the city budget, is that they agreed to the benefit reductions and increased costs.

You followed that with a totally unsupported assertion: "And let’s not forget that often when government employees take a “cut”—they manage to get the lost money back, one way or another. So, in the long run, “cuts” to these people is just a deferral."

Any evidence or references that support this off-the-wall statement?

Meadow Park

on Mar 26, 2013 at 3:10 pm

on Mar 26, 2013 at 3:10 pm

"FDR, himself a stong union supporter, opposed them."

Nah, wrong, boyo. You're taking one sentence from one FDR letter.

Now your man-crush, Ronnie Raygun, on the other hand detested unions at times (a self-loathing former union man, of course,) but did sign the law allowing collective bargaining for public unions in California, in 1968.

And president Ronnie did say “Where free unions and collective bargaining are forbidden, freedom is lost” on Labor Day, 1983.

Yup, the Ronster also said while president that unionizing is a human right "...one of the most elemental human rights—the right to belong to a free trade union"

And you're not obliged to put up with us in PA. Texas would love to have you. Lots of minimum wage jobs are open down there, if ya can handle the pollution.

Menlo Park

on Mar 26, 2013 at 3:16 pm

on Mar 26, 2013 at 3:16 pm

Gary -

Labor Unions are the best thing that ever happened to workers and their families. In many ways, the unions are responsible for the middle class comforts most of us (probably including you) still enjoy such as sick leave, health benefits, paid vacations, decent salaries.

The growth in inequality in this country since the 1970's closely tracks the loss of union power in this country. Without unions, who is there to argue for and protect the interests of the working class?

In my opinion we need more and stronger unions to represent workers' interests.

Corporate power and money has become too big and too powerful. First it 1) bought off Congress and rammed through deregulation, 2) drove the economy off a cliff through greedy and questionable business practices (sub-prime mortgages, derivatives, etc.) and 3) got the government to save their sorry butts through bailouts. And who suffered from their mistakes? Certainly not these titans of banking who caused the mess. In fact, once the economy began to recover, all of the new income gained from 2009-2011 went to the top 1 percent. ALL of the new income! Meanwhile:

- the average middle-class family has seen its income go down by nearly $5,000 since 1999, adjusting for inflation

- median net worth for middle-class families dropped by nearly 40 percent from 2007-2010. That’s the equivalent of wiping out 18 years of savings for the average middle-class family

- half of the new jobs that have been created since 2010 are low-wage jobs paying people between $7.80 and $13.80 an hour

- the effective corporate tax is at its lowest level since 1972, yet 1 out of 4 profitable corporations pays nothing in federal income taxes

- the United States has the most unequal distribution of wealth and income of any major country on earth and that inequality is worse today than at any time since the late 1920s

- the top 1 percent owns 38 percent of all financial wealth, while the bottom 60 percent owns just 2.3 percent.

I'd say it's pretty clear that if the middle class expects to have any hope of regaining some of this lost ground, they're going to need unions advocating for their interests. That would be unions in both the private and public sectors.

Gary, who would you have speak for the interests of working people if not the unions?

Another Palo Alto neighborhood

on Mar 26, 2013 at 6:09 pm

on Mar 26, 2013 at 6:09 pm

> Any evidence or references that support this off-the-wall statement?

Off the wall statement? Hardly ..

Web Link

Furloughs and Leave Programs Have Future Costs. Authorizing the administration to impose furloughs or personal leave programs (known as PLPs) allows the state to cut employee compensation costs without reducing the size of the workforce. Data from the SCO suggest that the recent furloughs and PLPs created a liability for the state by greatly increasing some employees' leave balances. As a result, furloughs and PLPs increased out–year costs that offset the near–term savings.

Sacramento Bee/May 10, 2010

Web Link

Service Employees International Union Local 1000 won a similar lawsuit that returned the remaining 7,500 State Fund employees to full hours and pay and restored their lost wages plus 7 percent. The governor has appealed.

------

The examples provided have to do with furloughs of State workers, and across-the-boards pay cuts. However, it would not be hard to find examples of government workers who took pay cuts having those cuts restored at a later time.

Another Palo Alto neighborhood

on Mar 26, 2013 at 6:15 pm

on Mar 26, 2013 at 6:15 pm

> and across-the-boards pay cuts.

and not simple pay cuts.

Old Palo Alto

on Mar 27, 2013 at 5:37 pm

on Mar 27, 2013 at 5:37 pm

Too funny! Buried deep in this lengthy verbose press release is the fact that healthcare costs will rise 9-10% by 2014 due to the Democrats voting for the Affordable Care Act (Obamacare). So now the city is somehow trying to blame active and retired employees in their city paid consultant study/report for this extra healthcare cost scenario. Even when you think that the city manager and city council can't possibly stoop any lower....